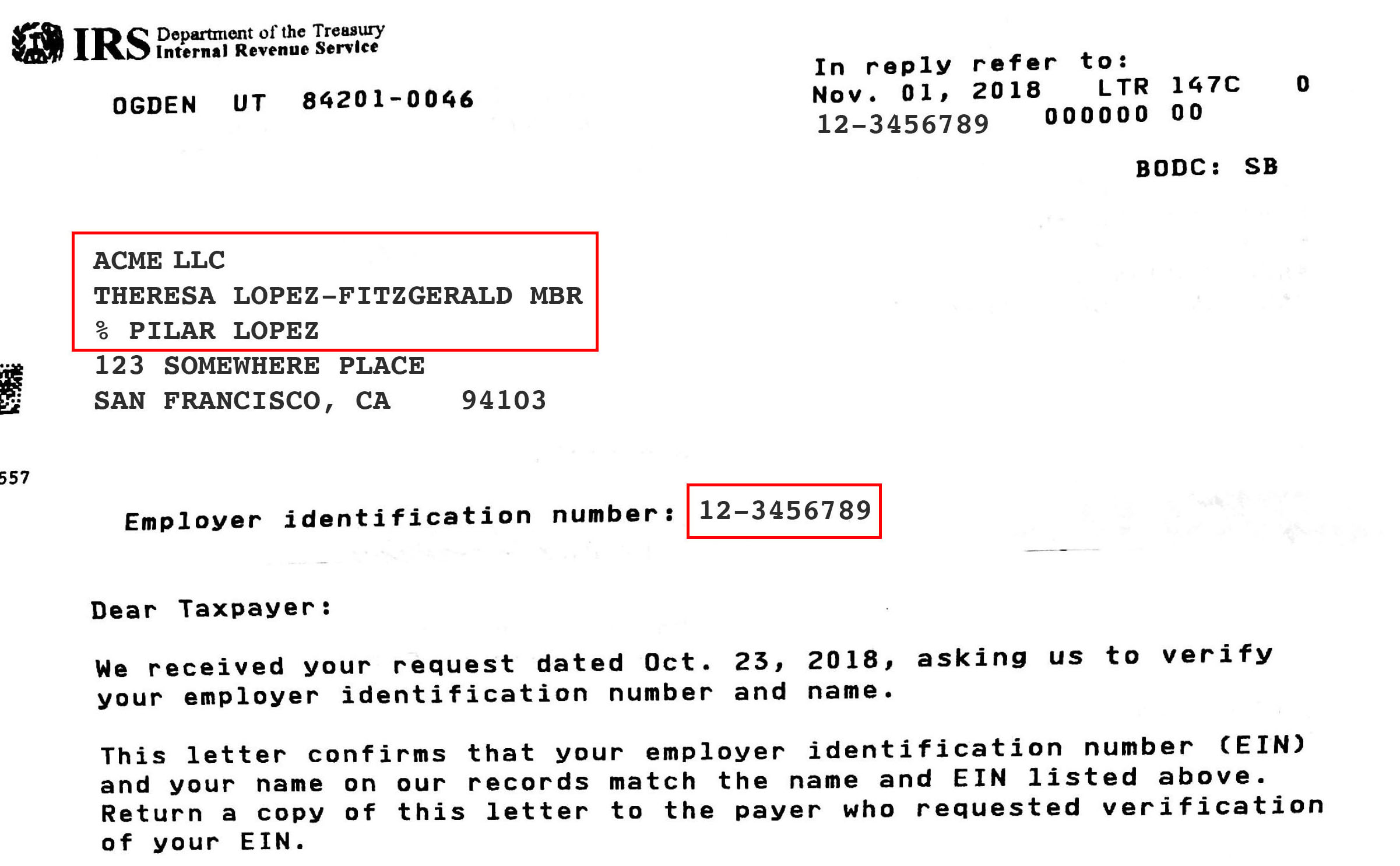

For US-based businesses, it is important that the information you enter for your legal name and tax ID number exactly match the information displayed on your official IRS-issued documentation, such as your SS-4 confirmation letter or your Letter 147C (the record of how your entity is filed with the IRS).

The IRS may display business name, and/or owner name, and/or organization name, or other unexpected combinations of information in their records. It is a common naming convention for LLCs to include both the owner name and the business name.

For this information to be verified with the IRS, the full name must be entered exactly as displayed on these forms, including upper/lower case, symbols, and punctuation placement. When in doubt, enter all information listed above the business address. If there are several lines above the address, enter all details on one line separated by single spaces.

If your legal name and tax ID on file match the information on your SS-4 confirmation letter but it is still unable to be verified with IRS records, it’s best to call the IRS and request a Letter 147C (the record of how your entity is filed with the IRS). If your platform is still unable to verify the information on your recently obtained Letter 147C, upload a copy of your Letter 147C in your account.

SS-4 confirmation letter examples

Example 1

If your entity name looks like this on your SS-4 confirmation letter, you might need to enter the following as your legal entity name: ACME LLC THERESA LOPEZ-FITZGERALD SOLE MBR

Example 2

If your entity name looks like this on your SS-4 confirmation letter, you might only need to enter the following as your legal entity name: ACME INC

Letter 147C examples

Example 1

If your entity name looks like this on your Letter 147C, you might only need to enter the following as your legal entity name: ACME INC

Example 2

If your entity name looks like this on your Letter 147C, you might need to enter the following as your legal entity name:ACME LLC THERESA LOPEZ-FITZGERALD MBR % PILAR LOPEZ

Additional Information

- You can request a Letter 147C by calling the IRS Business & Specialty Tax Line toll free at 1-800-829-4933.

- If your information on the account matches your IRS-issued documentation, and we are still unable to match with IRS records, upload a copy of your IRS-issued documentation in your account. We will check on our end to see if we can help verify it.

- If you have other questions or continue having difficulty verifying your information, contact support.